Heres the HMRC guidance:

https://www.gov.uk/government/publi...ing-online-and-paying-taxes-information-sheet

heres an explanation of the trading allowance:

https://taxaid.org.uk/guides/inform...e is £1,000,and wife trading in partnership).

The £1000 figure is the income (not profit) threshold before you have to register as self employed - its basically there as d8mok says to allow hobby businesses ( babysitting etc) to trade without having to concern themselves with self assessment, NIC or tax

theres also an online questionnaire

https://www.gov.uk/check-additional-income-tax

so, you either have to be buying stuff in order to sell at a profit (and turnover more than £1k), or have sold high value items at a profit in which case capital gains tax would apply.

As with all these things, you would need to be able to evidence that the stuff you sold were personal belongings rather than bought to sell in the event of of HMRC asking.

https://www.gov.uk/government/publi...ing-online-and-paying-taxes-information-sheet

heres an explanation of the trading allowance:

https://taxaid.org.uk/guides/inform...e is £1,000,and wife trading in partnership).

The £1000 figure is the income (not profit) threshold before you have to register as self employed - its basically there as d8mok says to allow hobby businesses ( babysitting etc) to trade without having to concern themselves with self assessment, NIC or tax

theres also an online questionnaire

https://www.gov.uk/check-additional-income-tax

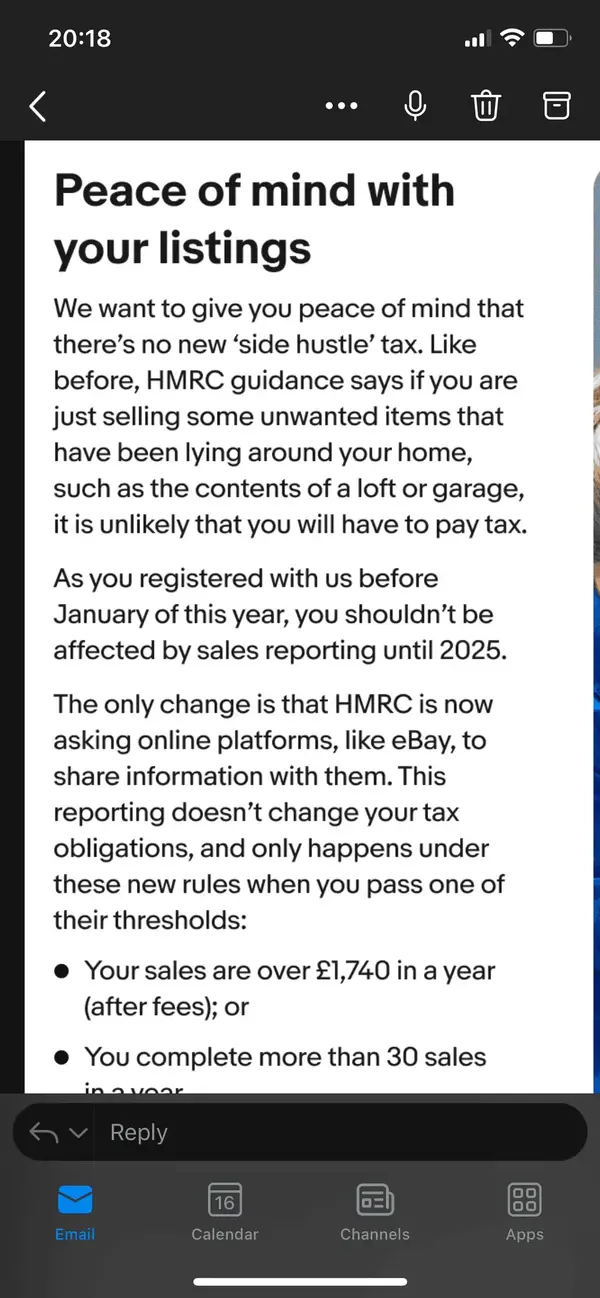

In order to pay tax on the goods or services you sell online, you either have to be trading or making a capital gain.

so, you either have to be buying stuff in order to sell at a profit (and turnover more than £1k), or have sold high value items at a profit in which case capital gains tax would apply.

As with all these things, you would need to be able to evidence that the stuff you sold were personal belongings rather than bought to sell in the event of of HMRC asking.