- Feedback

- View

Neil":3th0b9ej said:There's a big fallacy of the occluded middle in all of that - and big liberties being taking and assumed in the arguments made.Easy_Rider":3th0b9ej said:Very few of us are net tax contributes. That means even though we may not get direct benefits we still use services such as schools, hospital, roads etc etc. That means if we had to pay for everything directly but didn't pay any tax, very few of us would actually pay less than our current tax bill. So it takes large corporation taxes and rich top tax band people to balance the books (or not balance as we currently do)gtRTSdh":3th0b9ej said:I get the point, but how deos the wealth of the 10 men actually relate in reality?

This article explains it a bit better

http://www.thisismoney.co.uk/money/news ... state.html

I don't recall what the percentages are.

Probably the biggest number of higher rate taxpayers are nothing like mega rich - look at the top incomes in that table.

Going off an average month of direct taxation deductions in PAYE an NI, I've worked out my payments in direct taxation over 12 months are a few hundred shy of 20k - and whilst I'm probably a ways away from minimum wage, I'm hardly highly paid, nor mega rich. That's before you get to indirect taxation I'm paying, and in many cases, VAT on top of that. Are these articles considering any of that? The indirect taxation that probably cuts a lot harder at the lower end.

The people who you'd truly think of buggering off because of too much direct personal taxation are probably likely to be earning in the millions, and probably have mucho assistance by reasonably well paid accountants to minimise how much of their "income" actual goes to the tax-man. Something I very much expect is either not cost effective for, or they do not have the luxury of, for the occluded middle.

The reality is, it's rare, really, to see the super-rich directly affected by personal taxation - it tends to be Mr Average, in suburbia that takes the hit - after all, that's probably where the numbers are, in personal taxation.

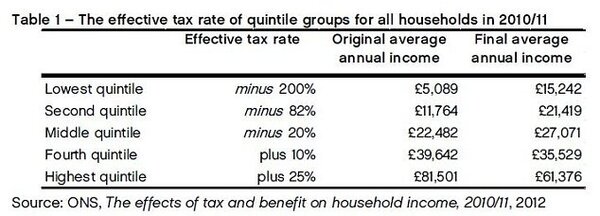

Sounds like you are in the 5th quintile of the household income split according to the article I posted so you would be a be contributer by far.

I don't think it's talking about the mega rich at all, simply only 40% of households are net contributors. That is those with a household income above £35,500.